-

Insert line 1

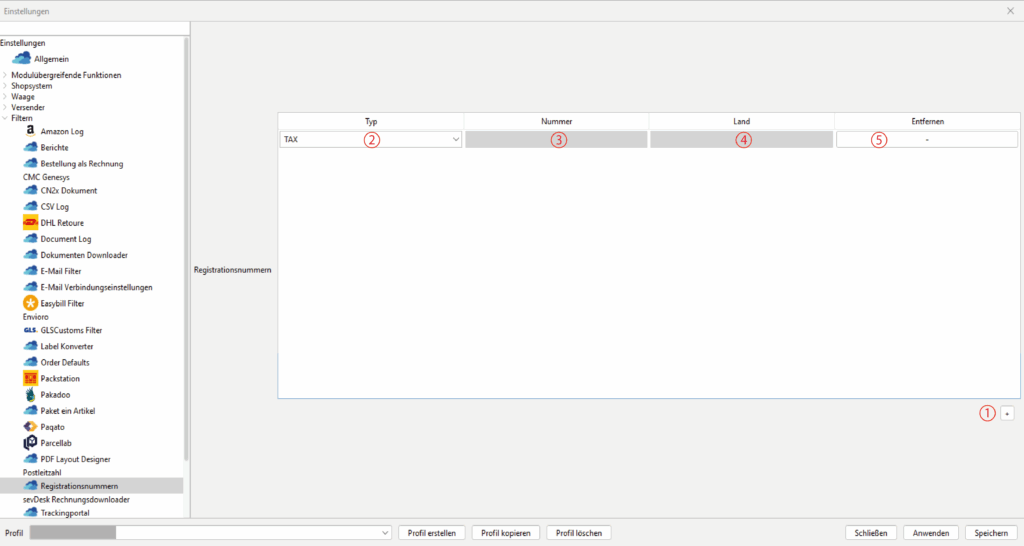

Use the "+" button to create a new line for each number to be transferred.

-

Number type 2

Select the number type from the preset list by clicking on the drop-down menu.

Explanations of the abbreviations below. -

Number 3

Enter the number matching the selected type here.

-

Country 4

Select the country for which your number is valid.

-

Remove line 5

Use the "Minus" button to remove the corresponding line from the configuration.

Number types

The most important number types briefly explained.

Abbreviation

Meaning

Explanation

VAT

Value Added Tax

In Germany also sales tax identification number (VAT ID)

VOEC

–

Since 1 April 2020, Norway has introduced a simplified VAT scheme called VOEC (VAT in e-commerce).

TAX

–

Tax as a term for taxes

IOSS

One Stop Shop System

An IOSS number is the specific identifier for the Import One Stop Shop system issued by the MSI (the country in which the taxable person is resident).

is eligible or opts for the scheme) assigns to the taxable person.

NIN

–

National Identification Number in Nigeria, a unique identification number for citizens and legal residents.

MRN

Movement Reference

Number

The MRN, short for Movement Reference Number, plays a crucial role in customs. In international trade, customs authorities issue an MRN, which is also known as a customs registration number.

SSN

Social Security Number

The Social Security Number (SSN) is an important identification number in the USA, which can also be used in connection with customs. It is primarily used for the administration of social benefits and for tax purposes

FTZ

Foreign-Trade Zone

Are specially designated areas that are excluded from the customs territory of a country (e.g. USA).

AEO

Authorized Economic Operator

AEO number: Identification number for companies with AEO status.

AEO status: Certificate of reliability and trustworthiness in the international movement of goods.

Advantages: Simplified customs clearance, fewer controls.

EORI

Economic Operators’ Registration & Identification number

The EORI number (Economic Operators’ Registration and Identification number) is an identification number that is issued to economic operators by the customs authorities of the European Union. It is used to identify companies and persons within the customs system.

uniquely identify and register them.

GST

Goods and Services Tax

The VAT or GST number is a unique identifier assigned by the tax authority of the respective country for the purpose of tax collection. The registration requirements vary depending on the country.

DAN

Deferment Account Number

The DAN number is a customs deferment account number that importers can quote to DPD UK to delay the payment of duties and taxes, according to DPD. It is used to postpone the payment of duties and taxes, which can be beneficial for companies that regularly import goods.

TAN

Transaction number

A TAN (transaction number) is a numerical security code that is used to authorise transactions in online banking. It serves as a second security level alongside the PIN to confirm payments and protect online banking access.

RGP

Reference number for

Border crossing point

A reference number for a border crossing point (border crossing point). It is used to identify the customs office and is used, for example, in the International TIR Data Bank.

CNP

Cod Numeric Personal

The CNP number (Cod Numeric Personal) is the identification number of citizens in Romania.

INN

International Nonproprietary Name

In certain cases, in particular for certain areas of application of pharmaceuticals, a product labelled under the INN may be duty-free, while a product with a different name (e.g. the trade name) is not duty-free.

MID

Merchant Identification Number oder

Manufacturer Identification Code

–

NID

Notification Import Documentation

A notification that the importer or customs agent sends to the terminal to allow the shipment to be released after EU customs declaration.

PAS

Identity card number

The PAS number is the identity card number or document number.

SDT

Single Document Number

The SDT number (Single Document Number) is a unique reference number that is used by customs for the customs declaration.

It replaces the former customs number and serves as an identification number for economic operators when exchanging information with the customs authorities.